A nine-week Financial Peace University course begins Sunday at a local church.

It goes from 1:45 to 5:30 p.m. at Central Christian Church, 1434 W. Second St., Seymour. The rest of the eight weeks, the class will be from 3 to 5:30 p.m. Sunday afternoons.

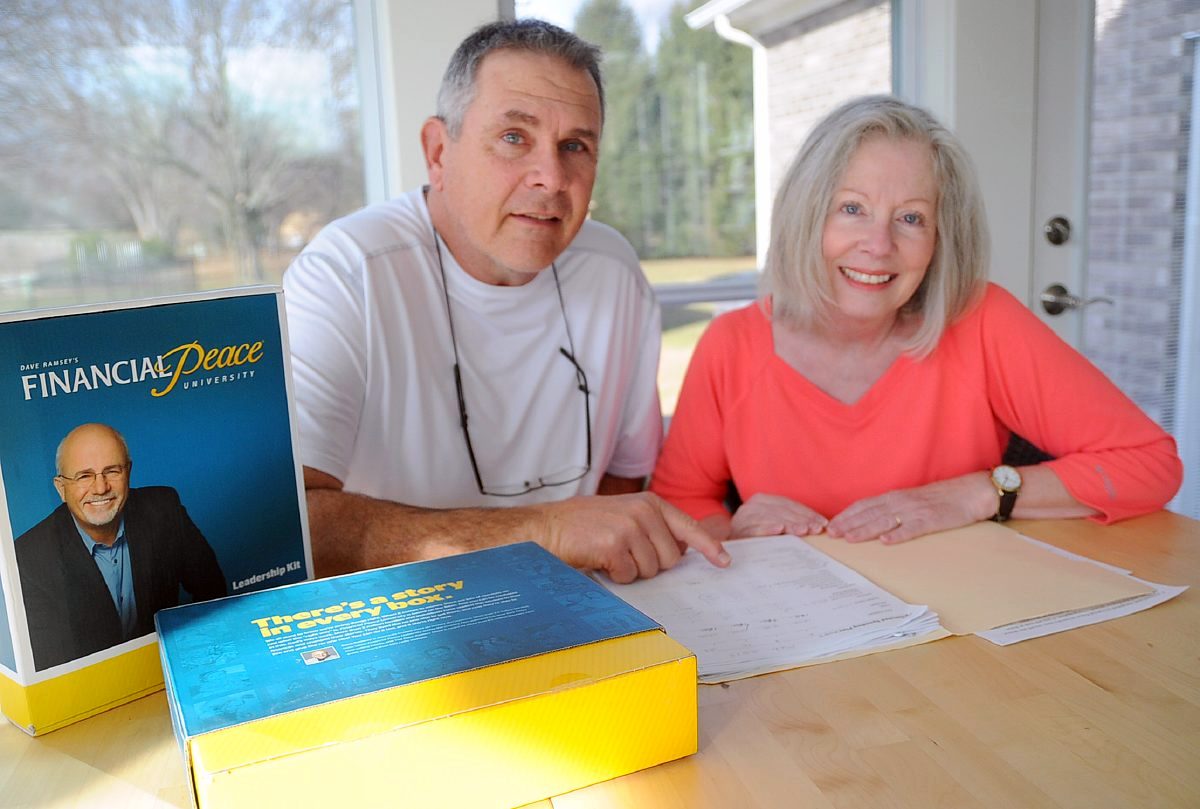

The course, led by Rhonda Earley of Seymour, includes nine video lessons featuring Dave Ramsey, Rachel Cruze and Chris Hogan. Participants will follow along with their workbooks.

Created by Ramsey, a financial expert and syndicated columnist, the digital course provides families and individuals with practical tools to gain control of their finances and set themselves up for long-term financial success.

“The course instructors do not get paid for leading the classes. We volunteer our time because we’re passionate about it,” Earley said. “My husband and I learned about budgeting and finances through the Dave Ramsey course and want to help others do the same.”

Topics include starter emergency fund, budgeting, paying off all debt, saving for emergency fund, investing for the future, buyer beware, insurance, retirement planning, real estate, mortgages and generosity.

The workbook for the class is $95, which attendees may pay at the first session. Cash is accepted or make a check payable to Central Christian Church. The workbooks also are available on Dave Ramsey’s website but at a higher cost.

“If there are those who want to attend but can’t afford it right now, we can certainly work with them,” Earley said. “Also, those who have attended the course in the past are welcome to attend and participate at no charge, but if they want a book, it will need to be purchased.”

Earley has been leading the course for more than three years, and her husband, city councilman David Earley, attends the classes unless he has a meeting to attend. She said he adds some fun into the class.

“We try to make it enjoyable because our biggest thing about Financial Peace is bringing hope to people who don’t have hope,” Earley said. “You will glean so much information it will blow your mind, and it’s truly an all-around financial picture.”

Earley said a lot of people have student loan debt that doesn’t go away if it’s federal. With federal student loans, the government can garnish a person’s Social Security benefits, wages and tax refunds to get its money back.

“Financial peace is a program that gives people hope, peace and organizational skills they never knew they had,” Earley said. “It gives all of the financial background you need for a healthy life, at least in the United States.”

Earley said it’s a digital world now, and the digital aspect of the course had been coming for a while.

“While I didn’t ignore it, I still prefer paper, and I believe that you’ve got to see it first. Then if you want to go digital after that, that’s fine,” Earley said. “I want people taking the course to physically experience on paper the money that’s coming out of their account when they do their bills.”

A few sessions ago, a young Seymour couple in their 20s, Brandon and Haley Davis, were in Earley’s class.

“Brandon and Haley were really on it and so financially mature, and they learned they didn’t need to have a big house or a lot of stuff,” Earley said. “The big twist is they are coming back to the class this Sunday to teach the digital and I’ll be teaching the paper.”

Earley said both digital and paper methods will be taught in the upcoming class, and participants can choose which way they prefer.

“At some point down the road, I believe the Davises might take the class over when I relinquish it after another year or two,” Earley said. “We need to get someone younger in here, and they will be great and can share their story.”

Another new twist to the course is that Earley has been bringing in guest speakers to come and share their success stories during the classes.

“The biggest thing about Financial Peace is you’ve got to make a brain change, which is how you think of your finances,” Earley said. “It does take a while, maybe a few months, to make changes, and there will be some mistakes.”

Earley said her goal is to have the course offered at every local church twice a year and that couples would attend her class and be inspired to teach the class back at their own churches.

[sc:pullout-title pullout-title=”If you go” ][sc:pullout-text-begin]

What: Financial Peace University

When: 1:45 to 5:30 p.m. for the first class Sunday; then 3 to 5:30 p.m. for the next eight Sundays

Where: Central Christian Church, 1434 W. Second St., Seymour

Cost: $95, which pays for the course kit

Information: Rhonda Earley at 812-498-4560

[sc:pullout-text-end]